According to recent statistics, about 53% of resumes and job applications contain falsifications. When applicants apply for a job, employment history can be one of the most important factors to human resource professionals. With the current competitive landscape of the job market, it’s common for candidates to embellish their accomplishments or outright lie on their resume regarding work or academic history. So how can employers separate the truth from the lies? Read on to learn 3 Ways To Spot Dishonest Candidates.

Most Common Lies on a Resume

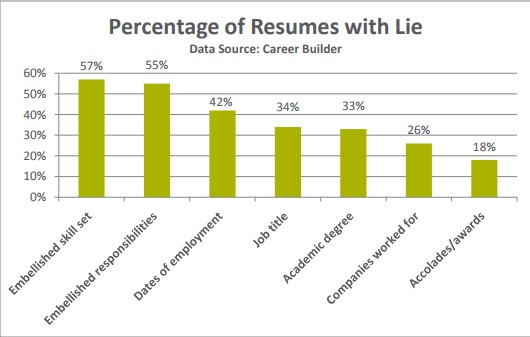

There are many reasons applicants falsify their credentials when seeking employment. Confirming

prior employment history helps determine the validity of the resume and if the applicant’s qualifications

fit the job requirements. So what are the most common lies found on a resume?

How to Spot a Dishonest Candidate

So you know the most common lies found on an application and resume. But what are some ways to spot dishonesty? Many recruiters are skilled enough to do simple social media searches to determine if a candidate’s resume is accurate. But even if dishonest candidates slip through the initial screening process, here’s how recruiters spot a liar before they hire:

1. Interview Techniques

If employers asked detailed questions about a candidate’s work experience, recruiters can tell by the depth of the response if the person is lying. With this technique, recruiters are looking for quality in the responses. As an example, if the candidate claims to have 10 years of experience in management, the recruiter can ask for examples of how the candidate hired, trained or fired employees. The quality of the candidate’s example should be a good indication if he/she is lying about their experience.

2. Conducting a Background Check

Detailed reports can be purchased to validate past work experience, degrees acquired, wages earned, criminal records, whether certifications are current, and much more. Companies would rather pay to find out now if a candidate is lying than to have something bad happen on the job.

3. Reference Checks

For this tip on How to Spot a Dishonest Candidate, we advise going beyond your typical reference check during the hiring process. References submitted by job applicants may be coached into saying only good things and provide an accurate representation of the candidate. Instead, recruiters may contact another former co-worker of the candidate to inquire about his or her performance. This technique catches the unassuming colleague off-guard and provides the recruiter with a way to validate what the candidate claims to have done on past jobs.

No Need To Lie!

For would-be job candidates out there, we understand that the job market can be highly competitive especially depending on your specific industry. However, we do advise you to stay away from fibbing your resume and job application. It doesn’t do you any good in that the rate of being caught with lies on your resume is high. You can be refused work and also fired when an HR manager finds out.

Instead, we recommend the oldest trick in the book, network! Studies show that over 80% of jobs have been obtained via referral. Many companies offer their employees hefty referral bonuses as incentives for referring good candidates to their jobs. By making friends with employees through networking sites such as LinkedIn, or at job fairs and local networking events, job seekers can show how their personalities and aptitude are a match for employers. This makes not having an exact match in experience on your resume less of an issue.

At Accredited Background Checks, we pride ourselves in providing reliable, confidential employment screenings and background checks. Call us today if you have any questions about conducting employment background checks for your employees.